When it comes to financial planning, there’s a lot to consider. As part of the process, it’s important to review the distinctions between different investment and savings vehicles to understand how and when earnings are subject to income tax. Learn how these tax implications align with your short and long-term financial goals, considering various factors like stage of life, career plans, retirement horizon and the legacy you want to build. Anisa Dunn, SVP, Private Banking Regional Sales Manager, provides insight so you can be equipped to evaluate the best options for your personal situation.

Nothing can be said for certain. Except…

In the words of Benjamin Franklin’s simple, yet profound, proverb, “Nothing can be said for certain, except death and taxes.” Said more candidly – taxes are here to stay. But how does this impact financial planning? Well, one would be remiss to avoid considering the impact that taxes will have on an individual’s personal financial plan – both now and in the future.

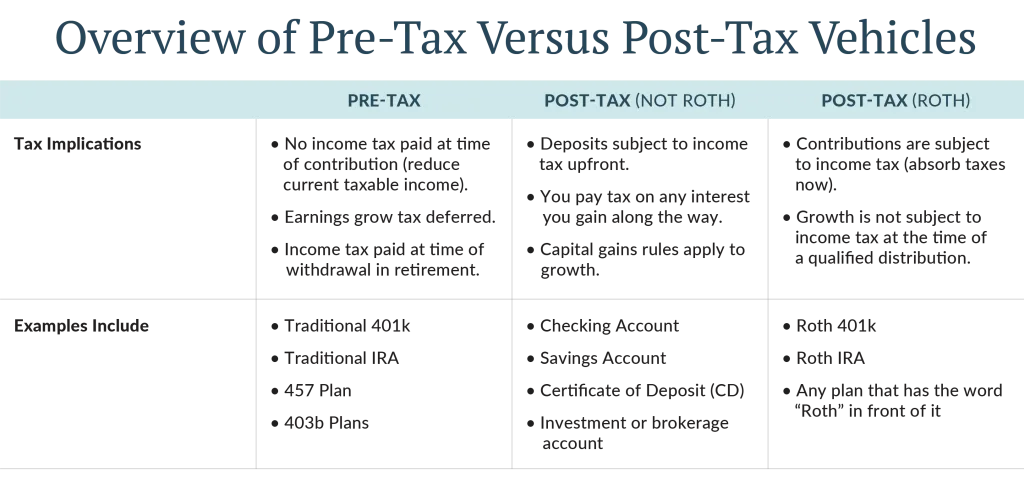

Pre-tax and post-tax – what’s the difference?

“Pre-tax” and “post-tax” are terms commonly heard in relation to retirement and financial planning. Both can be used as a part of an effective strategy to help you achieve your financial goals.

What are pre-tax accounts?

Pre-tax retirement accounts provide a distinct opportunity for growth because earnings grow tax deferred. While money can be contributed income tax free, future withdrawals made in retirement will be subject to standard income tax, based on the individual’s tax bracket at the time of withdrawal. Common examples of pre-tax investment accounts include Traditional 401ks and Traditional IRAs.

Traditional 401k

Traditional 401ks are employer-sponsored retirement saving accounts. They can be great wealth-building tools, especially if the employer offers a matching contribution. Pre‐tax contributions and earnings in the Traditional 401(k) are tax deferred and taxed at distribution. The contribution limit for 2022 is $20,500 and the maximum catch-up contribution is $6,500 for individuals age 50 and older.

Traditional IRA

A Traditional Individual Retirement Account (IRA) is not employer-sponsored and can be opened by anyone who receives taxable compensation during the year. If you, or your spouse (if you are married) contributes to a retirement plan at work, then there are income limits that might restrict your ability to deduct your IRA contribution. Like Traditional 401ks, pre-tax contributions and earnings grow tax deferred, and earnings are taxed at the time of distribution. The contribution limit for 2022 is $6,000, and the maximum catch-up contribution is $1,000 for individuals age 50 and older.

What are post-tax accounts?

Post-tax accounts are subject to income tax upfront. Earnings are deposited into an account where it can accrue interest or growth. You pay taxes on any interest you gain along the way. Common examples of post-tax accounts include:

- Checking accounts

- Savings accounts

- Certificates of Deposit (CDs)

- Brokerage or investment accounts

What are post-tax Roth accounts?

Post-tax Roth accounts, on the other hand, provide a unique distinction. While contributions are funded with post-tax dollars, earnings are not subject to income tax at the time of a qualified distribution. Examples of post-tax Roth accounts include:

Roth 401k

Roth 401ks are subject to employer availability. Contributions and catch-up limits are the same as a Traditional 401k. While contributions are subject to income tax upfront, qualified distributions are completely income tax free.

Roth IRA

If an individual has earned income below a certain threshold set by the IRS, a Roth IRA may be a good option. Like Roth 401ks, contributions are made after tax and distributions are not subject to income tax. Roth IRAs may provide more flexibility and control as there are no required minimum distributions (RMDs) in retirement.

It is hard to anticipate what the tax brackets will be when you retire. But as Benjamin Franklin predicted, they are not likely to go away.

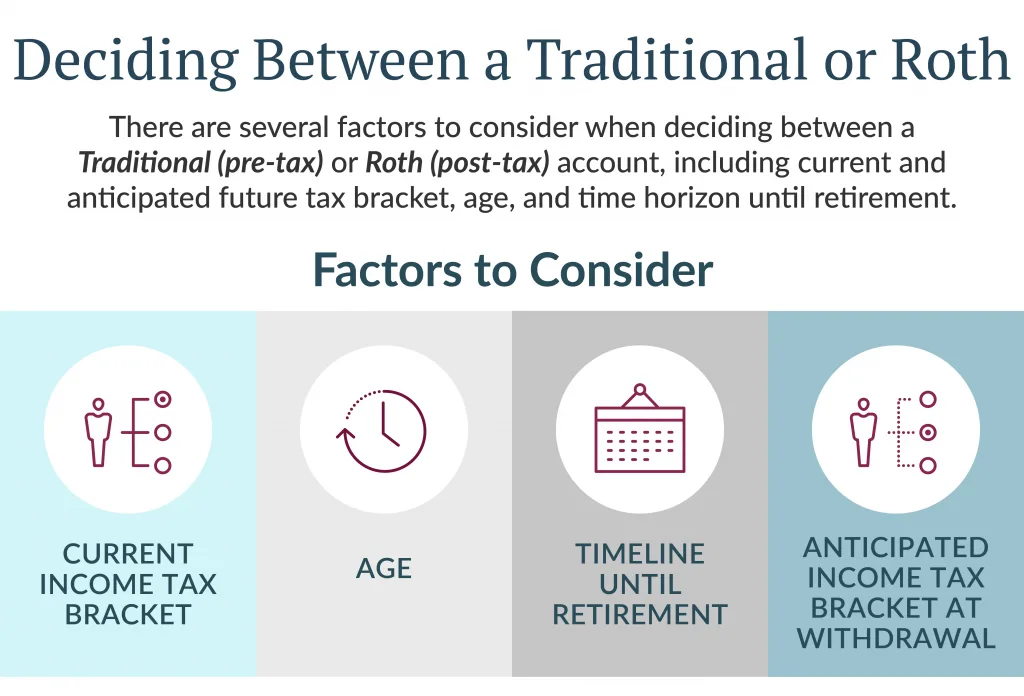

Who should consider a pre-tax account?

Pre-tax accounts are often an attractive option for individuals who are currently high-income earners in a high tax bracket. For individuals who expect lower income in retirement, a pre-tax option may be suitable.

Additionally, contributing to a pre-tax account may be appropriate for someone who desires to reduce their current income to avoid bumping up to a higher tax bracket, essentially lowering their tax liability for the year.

Who should consider a post-tax Roth account?

On the other hand, someone who expects to have a higher income rate in retirement than in their working years may find a post-tax Roth vehicle advantageous. For example, a Roth account may appeal to younger individuals with a long timeline until retirement. Young professionals and those early in their careers may be in a lower income tax bracket. By paying taxes now, these individuals can avoid paying a higher income tax when withdrawing the funds in retirement.

Additionally, those who desire to reduce taxable income during retirement may consider contributing to a Roth account.

Roth Accounts – Legacy Building Tools

Roth accounts can also be used strategically to build a legacy. Individuals who do not plan to use accumulated assets in their lifetime may look to pass down the money to their heirs. With a Roth account, beneficiaries will inherit the funds without being required to pay income tax on the distributions.

What role do capital gains play in tax planning strategies?

First, let’s define a capital gain. Simply said, a capital gain is a profit from the sale of a property or an investment. A short-term capital gain is anything bought and sold in under one year. Short term capital gains are subject to income tax rates. A long-term capital gain is anything sold after 12 months of ownership and is subject to the capital gains tax rate. The capital gains tax rate is generally lower than income tax rates. For this reason, it is often preferred to hold investments until the profits become long term, taking into consideration the potential value of the investment.

Example: If an individual buys one share of Amazon stock on January 5, 2022, and sells the share before January 5, 2023, the gain on the sale is considered short-term, and taxed at the regular income rate. If the stock is sold after January 5, 2023, the gain is considered a long-term capital gain and therefore taxed at the lower capital gains rate.

Consider a balanced approach

Because tax rates and legislation are continually subject to change, it’s important to stay apprised of proposed changes and talk to a financial advisor about adjustments to consider each year. Diversifying assets into Traditional and Roth vehicles is just one way to prepare for potential changes to avoid becoming “stuck” with all your eggs in one basket. Having funds in separate buckets that are subject to different rules and taxation may provide more flexibility and options as you decide how to spend your money in retirement.

Work with a team of financial professionals to create a proactive strategy

The details outlined here only skim the surface. A trusted financial professional can provide objective, non-biased advice to help you assess your options and proactively plan for your financial future. We’ll look at the big picture and get to know you, your family, and your goals so you have the confidence to follow your dreams. To learn more, connect with one of our advisors today.